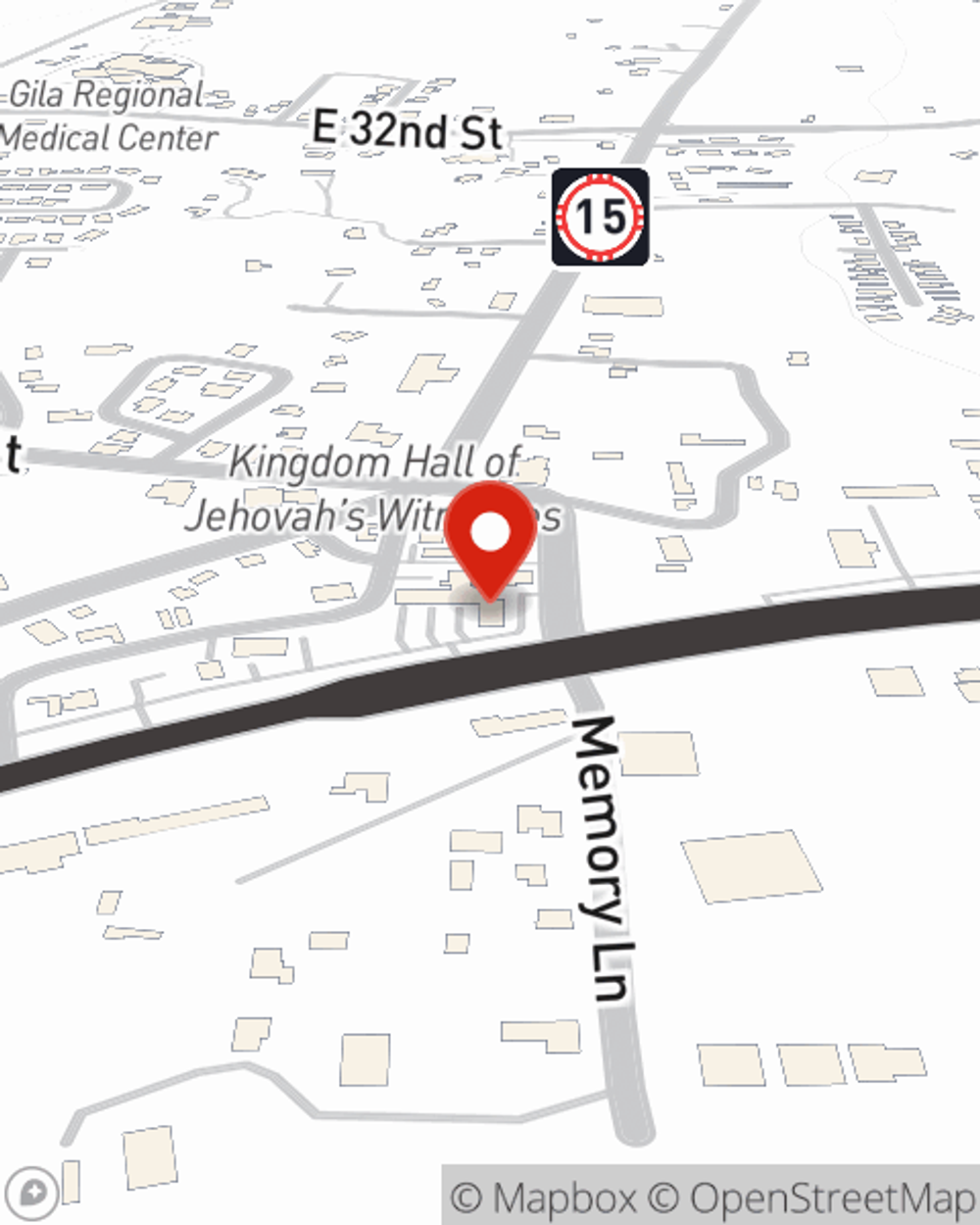

Business Insurance in and around Silver City

One of Silver City’s top choices for small business insurance.

Helping insure small businesses since 1935

- Silver City

- Grant County

- Hidalgo County

- Luna County

- Sierra County

- Greenlee County

- Catron County

- Dona Ana County

- Cochise County

- Apache County

- Deming

- Safford

- Thatcher

- Las Cruces

- Pima

- Willcox

- Morenci

- Lordsburg

- Bayard

- Hatch

- Duncan

- Clifton

- Graham County

- Santa Clara

Insure The Business You've Built.

Being a business owner isn't easy. You want to make sure your business and everyone connected to it are covered in the event of some unexpected trouble or loss. And you also want to care for any staff and customers who stumble and fall on your property.

One of Silver City’s top choices for small business insurance.

Helping insure small businesses since 1935

Cover Your Business Assets

With options like extra liability, worker's compensation for your employees, errors and omissions liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Jon Saari is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does happen.

Take the next step of preparation and reach out to State Farm agent Jon Saari's team. They're happy to help you learn more about the options that may be right for you and your small business!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Jon Saari

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?